– Enrolled College students Only

– Maximum one loan per semester of up to $seven-hundred

– A student with a previous-due balance can not borrow a brief-term mortgage

– The cost deadline for the mortgage is similar as the ultimate cost deadline for the current semester

– Failure to repay will stop registration in future semesters

– Dis-enrollment will cause the mortgage to enter repayment immediately

– There’s a service cost of $5 per $100 borrowed

– There is a $10 late wonderful for late payments

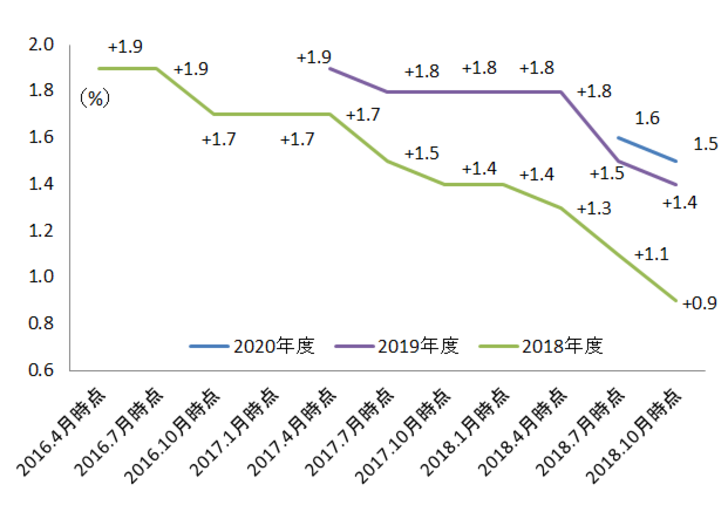

– Curiosity will accrue after maturity at a charge of 1% per month on the unpaid steadiness

– College students must sign a promissory observe which can include extra phrases

Don’t cease rising your emergency account even when it comprises enough cash to cowl six months of residing expenses. If an emergency pops up, and also you spend a few of your emergency cash, site (http://shadowaccord.nwlarpers.org/index.php?title=You_Want_Me_To_Wear_What) work towards replacing the spent sum. That approach, if another emergency pops up, you may be financially ready to handle it the following time, too.

Anecdotal accounts can simply overstate the concrete good points to borrowers from microcredit. For instance, extensively cited analysis by the Canadian Worldwide Growth Agency (CIDA) reviews that “Girls particularly face vital boundaries to achieving sustained increases in earnings and bettering their status, and require complementary help in other areas, reminiscent of coaching, marketing, literacy, social mobilization, and other financial services (e.g., consumption loans, financial savings).” The report goes on to conclude that the majority borrowers understand only very small gains, and that the poorest borrowers profit the least. CIDA also found little relationship between mortgage repayment and enterprise success.

We all know that business MFIs will put debt onto another family member ought to one thing occur. It’s commonplace for a lot of commercial MFIs to make their clients take out life insurance coverage as a part of their service charge on the mortgage. The heavy handed method of commercial MFIs does not assist with poverty alleviation. Taking collateral from families who are dwelling on lower than £1 a day or shifting debt onto one other family member goes against our social mission.