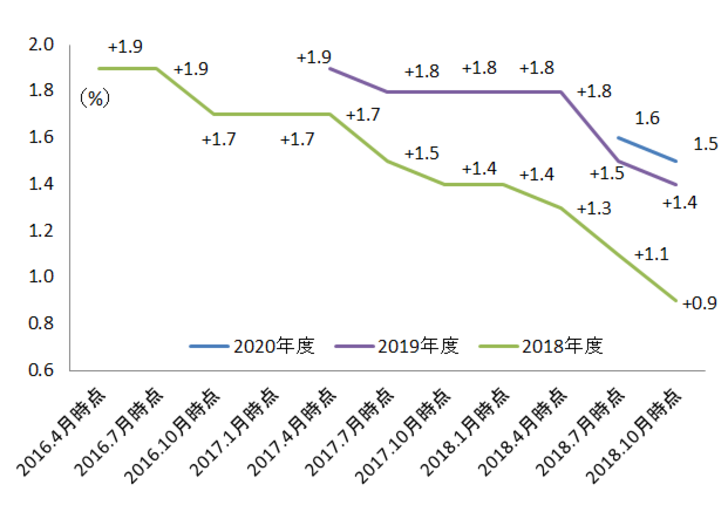

Over the course of a lifetime, many of us will find yourself paying a large sum of money in interest to creditors and financial institutions. Whether or not it’s pupil loans, personal loans, mortgages, credit playing cards or automobile loans, the sum of money many people pay is significant. In 2020, the typical client held $92,727 in debt, according to Experian, the credit score bureau.

Sometimes, payday lenders won’t examine your credit score rating and monetary scenario, however there is a great purpose behind that. They know very well that you’ve a nasty credit score rating and your monetary situation is not good. These lenders don’t care when you can pay the cash on time and only want to lure you in a debt cycle.

How does it really work, although? It’s somewhat slippery trying to figure that out. On the one hand, the site proudly says that it gives free debt counseling and help by “web’s first get-out-of-debt group” (the weird grammar is theirs, not ours) and that they’ve helped over 470,000 neighborhood members to get out of debt. And yet, out of nearly half 1,000,000 members, there are only 12 testimonials on the site?

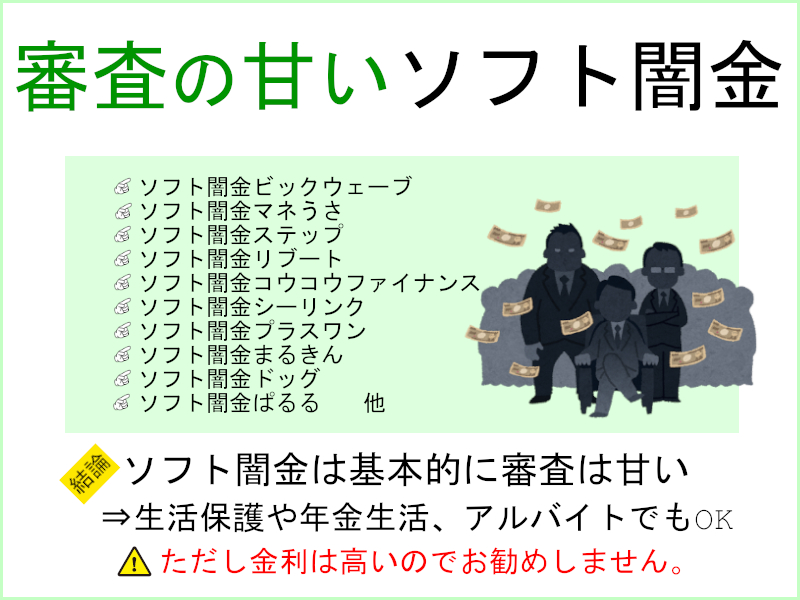

They can be an awesome various to the everyday SBA (7)(a) loans. Even with lower than stellar credit, the applying may be stuffed in within an hour and the money may be deposited within one enterprise day. For small enterprise loans, ソフト闇金プレステージ sites comparable to Lending Club present a peer-to-peer lending platform the place borrowers and lenders could be introduced collectively utilizing the phrases and situations on the platforms. Given the small success price of SBA loan purposes, alternative lending choices might be ideal.