A business time period loan can present financing to assist homeowners expand their business in a selection of how. Real property might be purchased or refinanced, needed equipment might be purchased, or a one-time improve in working capital might be acquired. Funds are disbursed up front and are paid back over a sure variety of years in equal, monthly installments. The supply of repayment on time period loans is the money move generated from the borrower’s business. Time period loans are usually secured with collateral and the term on the be aware is anyplace from 3-20 years and matches the helpful life of the collateral and the aim of the mortgage. Loans secured with actual estate typically have a time period of 15-20 years. Talk to considered one of our mortgage officers to see if a enterprise time period loan may be right for you.

Mortgage applications can be downloaded at www.sba.gov/disaster. Applicants might apply online using the Digital Loan Software (ELA) via the SBA’s safe webpage at https://disasterloan.sba.gov/ela. Completed purposes must be returned to the native DLOC or mailed to: U.S. Small Business Administration, Processing and Disbursement Middle, 14925 Kingsport Street, Fort Value, TX 76155.

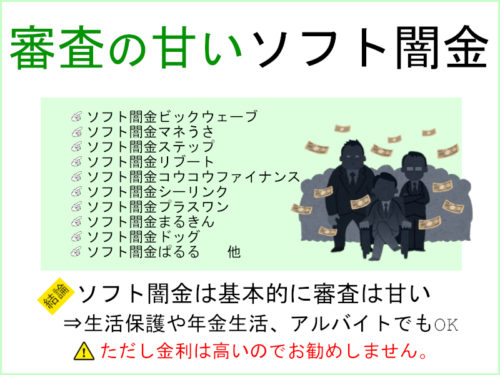

Unfortunately, the very worst impacts of microcredit in South Africa have taken place in the poorest and most weak areas, particularly around the mining district of Rustenburg. Right here, lots of South Africa’s largest and most prestigious banks opted to pour in huge amounts of microcredit in order to quickly generate profits at the expense of the hardest-working but most weak people conceivable. The results of pursuing this goal was huge earnings for the private banks and ソフト闇金まるきんに融資を申し込む microcredit institutions and, after all, large financial rewards for his or her high-profile CEOs, however private devastation for the overwhelming majority of already heavily indebted mineworkers and their families. Sadly, largely in an effort to make additional cash for its managers, even the ANC-linked and as soon as radical National Union of Mineworkers got involved in pushing microcredit onto its poor members by its part-possession of UBank.

Simone Bowie Jones is a accomplice and Shaniel Might is an affiliate at Myers, Fletcher & Gordon and they’re members of the agency’s Business Department. They could also be contacted through simonebowiejones@mfg.com.jm , shaniel.may@mfg.com.jm or www.myersfletcher.com. This article is for common data functions only and doesn’t represent legal recommendation.

Microcredit has notably been attributed to preventing poverty in Bangladesh and the case of Bangladesh has impressed the worldwide microcredit movement. Grameen and different revolutionary microfinance institutions have provided far more than just “financial companies to poor people.” It’s been a multifaceted approach to combating varied obstacles shackling the poor to their situations. It has included integrating well being training with microcredit, monetary literacy, technical coaching, and opportunity for self-determination.