It’s important to not take a gander at short time period loans in the same way you would customary financial institution loans. Customary financial institution loans premium is appraised on an APR or yearly fee. Very almost all quick term loans have reimbursement phrases of short of what one year, therefore there isn’t any APR. The premium price is usually increased than a financial institution mortgage but equal with the hazard of giving.

A major good thing about utilizing your credit card for scholar loan funds is earning rewards. With the typical pupil carrying $32,731 in pupil loan debt, in response to Forbes, that is a big expense you could possibly be placing to work for your benefit. For instance, paying a balance that massive with a 2% money-back card would earn you about $654 in money back. Cost that quantity to the Blue Business Plus Bank card from American Categorical and you’ll have 65,462 Membership Rewards points, worth $1,309 in accordance with TPG valuations, that you could put to good use.

We provide an software online in which you request a mortgage sum and related phrases. While not all mortgage purposes are accredited, we do our best to assist you find a mortgage sum you possibly can afford. Whether or not from your laptop at residence or your cell, apply for a loan because it suits your wants 24/7.

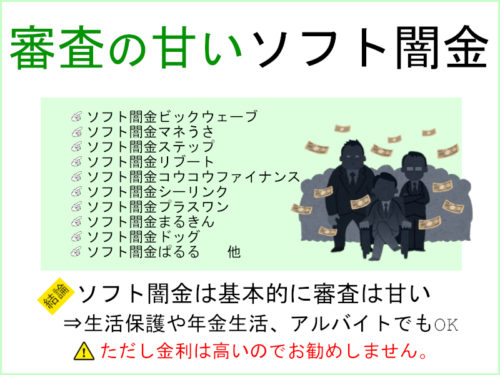

NGOs are one in all the important thing players in the sphere of micro-financing. They assist the reason for micro-financing by taking part in the middleman in a number of dimensions. Non-governmental Organizations (NGOs) played a significant position in rural reconstruction, agricultural growth, and rural development even throughout a pre-impartial era in our country. NGOs grew to become a supplementary company for ソフト闇金まるきん the developmental activities of the government and in some circumstances, they grow to be alternate options to the government.

Alternative of Regulation: This term refers to the distinction between legal guidelines in two or extra jurisdictions. For instance, the laws governing a particular a part of a loan agreement in a single state could differ from the identical regulation in another state. You will need to establish which state (or jurisdiction’s) laws will apply. This time period is often known as a “Conflict of Regulation.”