Reliance Cash – Reliance Cash provides microfinance solutions at nice interest rates by partnering with microfinance establishments (MFIs). The documentation required for this is limited. Wholesale funding is offered to MFIs for on-lending. The lender additionally helps with ensures in order that MFIs are in a position to get loans from alternative sources.

– ICICI Financial institution – ICICI Financial institution has been partnering with MFIs for not less than 10 years to provide microfinance loans to those institutions. At the moment the financial institution is focussing on the following: – Setting up a worthwhile and healthy lending enterprise with select MFIs

– Investing that enables the wholesome growth of the microfinance business in India.

The mortgage is a one-time resolution, which suggests you will need to reapply for a mortgage and qualify each time you desire additional funds. When you don’t have sufficient money to pay your credit card account in full, you’ll be able to choose the ‘minimum fee’ option. If you’re taking out a mortgage, you should pay the equivalent month-to-month income (EMI).

Clearly the duty of figuring out and measuring the prices of pathological playing is removed from a straightforward exercise. Even those effects that appear, at first glance, to be direct and tangible prices might, on nearer investigation, be overstated or merely transfers. The need to have interaction in far more analysis in the world of figuring out and estimating the impacts of pathological playing should come as no shock. There seems to be a dearth of literature coping with the cautious examine of the financial and social effects of both on line casino playing and playing in general (Federal Reserve Financial institution of Boston, 1995).

Balboa Capital has a great fame in the marketplace, which can be essential. An easy approval process is not worth it in case your lender is unscrupulous or costs hefty charges. Its curiosity rates, while greater than a bank or SBA loan’s charges, are aggressive with different various lenders. Balboa Capital has an A+ ranking with the better Business Bureau and has been accredited by the company since 1999. (That is to not say it hasn’t had buyer complaints through the years.)

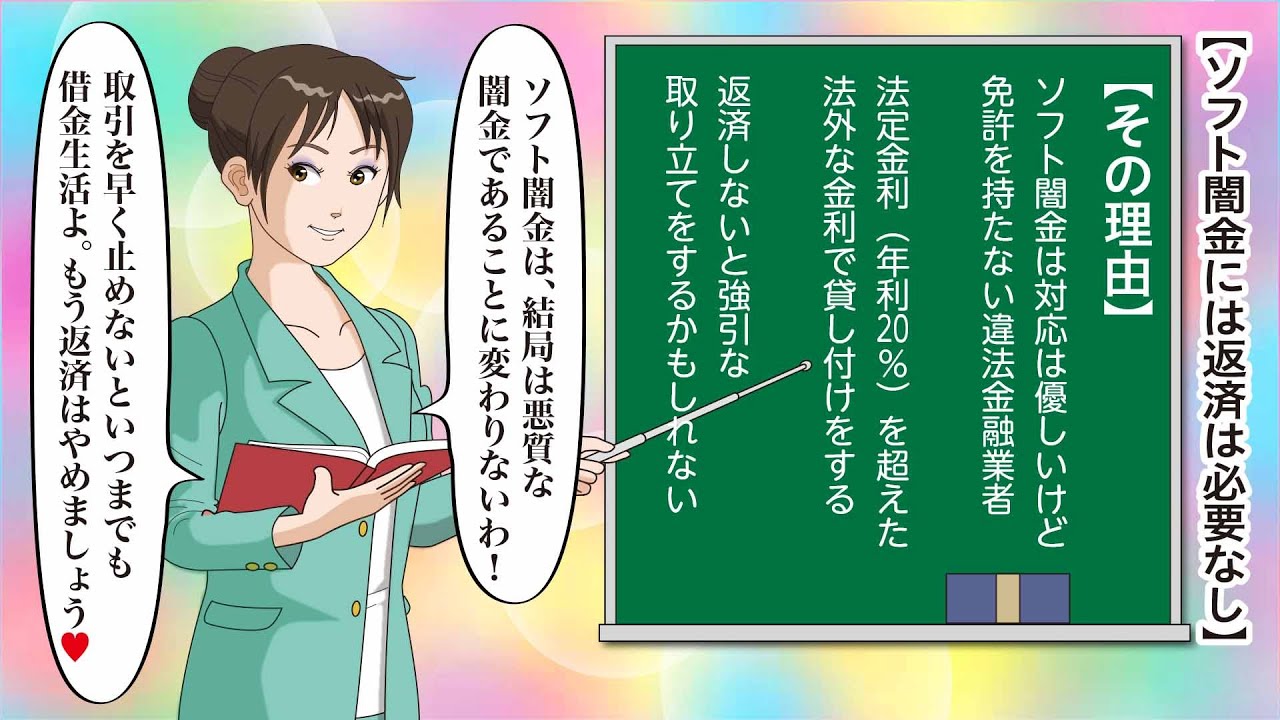

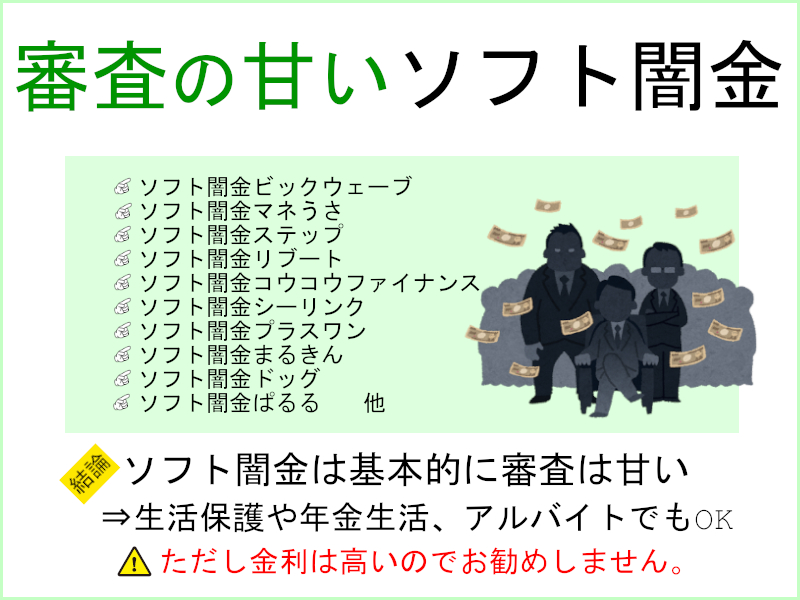

No Credit Check Automotive Loans To Make Each Automotive Purchaser Profitable . It is difficult to finance a brand new or used automobile when you will have bad or no credit score rating. Banks and credit score unions might altogether refrain from working with borrowers who’ve subprime credit score or ソフト闇金まるきんの公式サイトはこちら may run credit checks for assessing the overall dangers involved in extending you automobile credit score providers.

.jpg/1200px-Tw3_abandoned_site_(boatyard).jpg)