When you’re considering taking out a loan, Peterson recommends looking not just at the whole quantity of the loan, however the size of the installment funds and whether or not you’ll afford them. A very powerful yardstick, he says, is the whole debt-to-earnings ratio, which compares your obligations – mortgage or rent payments, automotive payments, bank card funds, pupil debt and so on – to the quantity of gross – that is, pretax – earnings you have coming in every month.

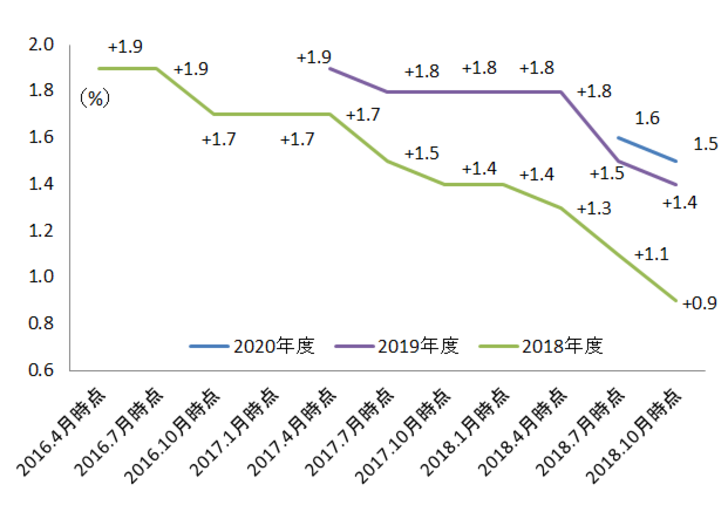

One cause to go slowly is that it takes time to guage the impression of modifications in Fed policy. Merely by signaling that it plans to lift charges, the Fed already has initiated a significant response in financial markets. Average curiosity rates on house mortgages, for instance, have climbed sharply. The month-to-month mortgage fee required to purchase a median-price home has elevated to $1,690 from lower than $1,165 a year in the past, in line with Roberto Perli, the head of world coverage analysis on the funding financial institution Piper Sandler.

Two examples display this. If there is a theater with 2,000 seats (a fixed provide), 高い融資率ならソフト闇金まるきん the price of the performances will depend upon how many individuals want tickets. If a very popular play is being carried out, and 10,000 individuals wish to see it, the theater can increase prices in order that the richest 2,000 can afford to buy tickets. When the demand is much higher than the availability, prices can undergo the roof.

.jpg/1200px-Tw3_abandoned_site_(boatyard).jpg)