Many auto loans are secured. This implies that they are assured by a lien on the underlying asset – on this case, the car. In case you fall behind funds, your lender has the authorized proper to grab, or repossess, the car. As soon as the loan is paid off, the lien is lifted and the lender not has the appropriate to repossess the car.

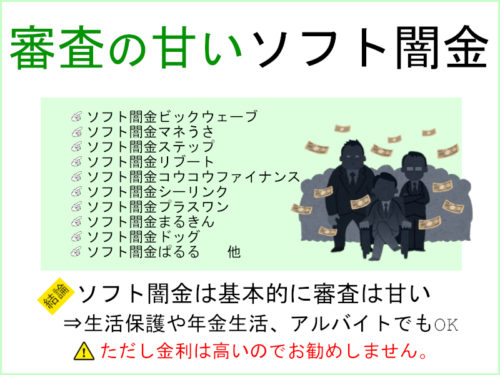

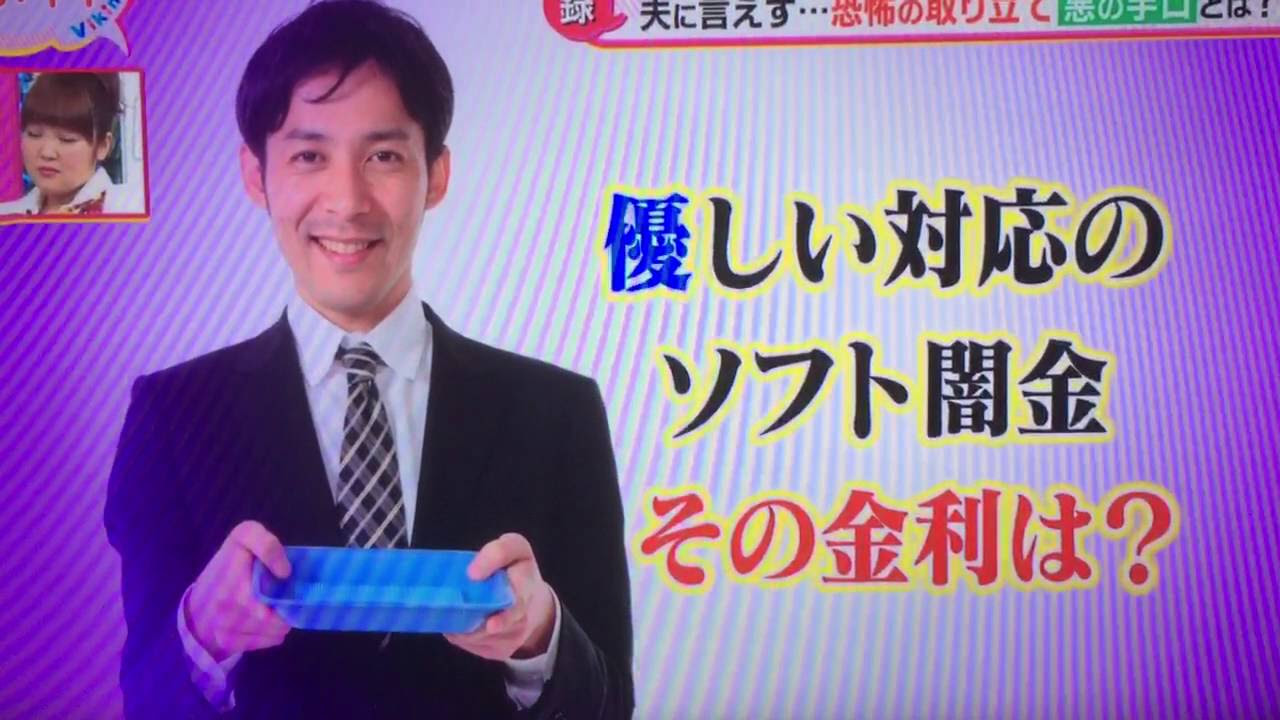

If you are having hassle just making the minimal funds, you may need to see if you’ll be able to negotiate an inexpensive fee plan along with your creditors or consult a nonprofit credit counseling agency to see if they can negotiate one for you. In any case, you should definitely prioritize your rent or mortgage funds and car funds over unsecured debt like credit cards so you don’t lose your private home or automotive. If all else fails, ソフト闇金プレステージへの申し込みはこちら bankruptcy can provide you a clean slate to rebuild your finances.

“When we have been first beginning out, we were not able to get conventional funding, because there simply isn’t funding for small businesses via traditional banks. They need you to perform first before they’ll allow you to. Luckily, we got here throughout OnDeck, and we’re so grateful for the pliability they’ve supplied us over the years as we’ve grown.”

Since credit cards offer a line of credit as an alternative of a set amount of money upfront, using them can also grow to be a slippery slope. It’s far too simple to make use of credit to pay for purchases you can’t afford, then make a small fee every month, letting your stability balloon over time.